Power of Compounding

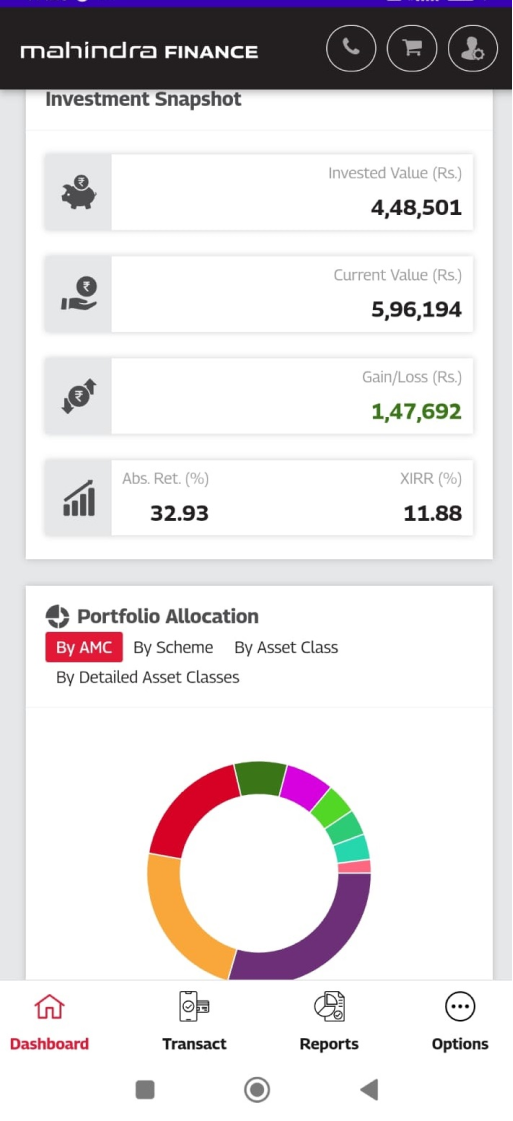

Make your money grow faster by remaining invested and earning returns on both principal and accumulated gains

A Systematic Investment Plan consists of investing fixed amounts of money in mutual funds regularly over a long period of time to generate substantial wealth. The essence of SIPs is investing regularly and taking advantage of the volatility in the prices of equity shares by minimising the average cost of buying mutual fund units to maximise returns.

Make your money grow faster by remaining invested and earning returns on both principal and accumulated gains

A disciplined approach over the long term maximises wealth creation opportunities

Investing regularly allows to minimise the average cost of buying units and increases returns over the long term.

Can choose the amount and frequency of Investments

Helps in achieving your financial goals

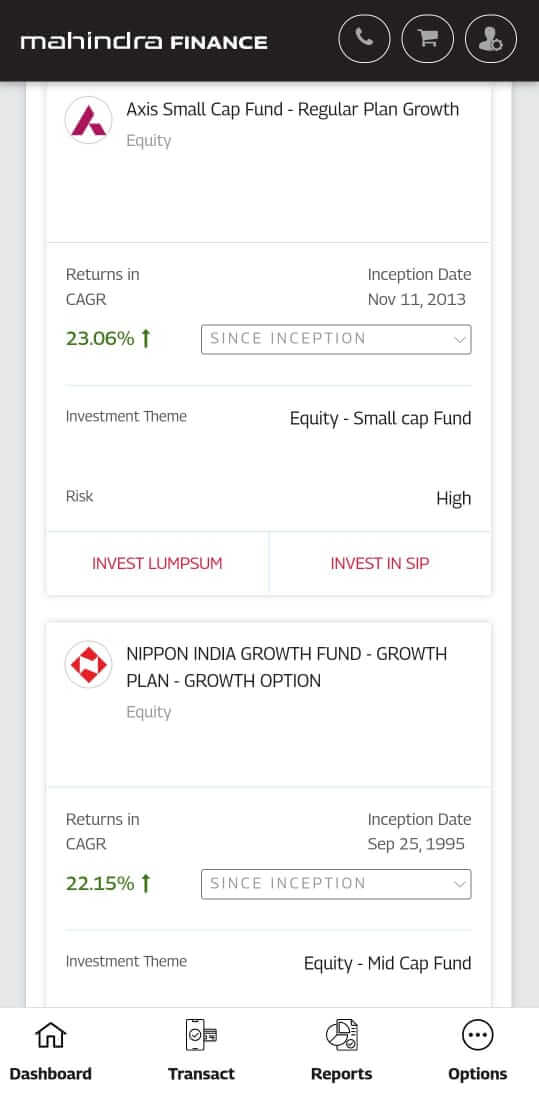

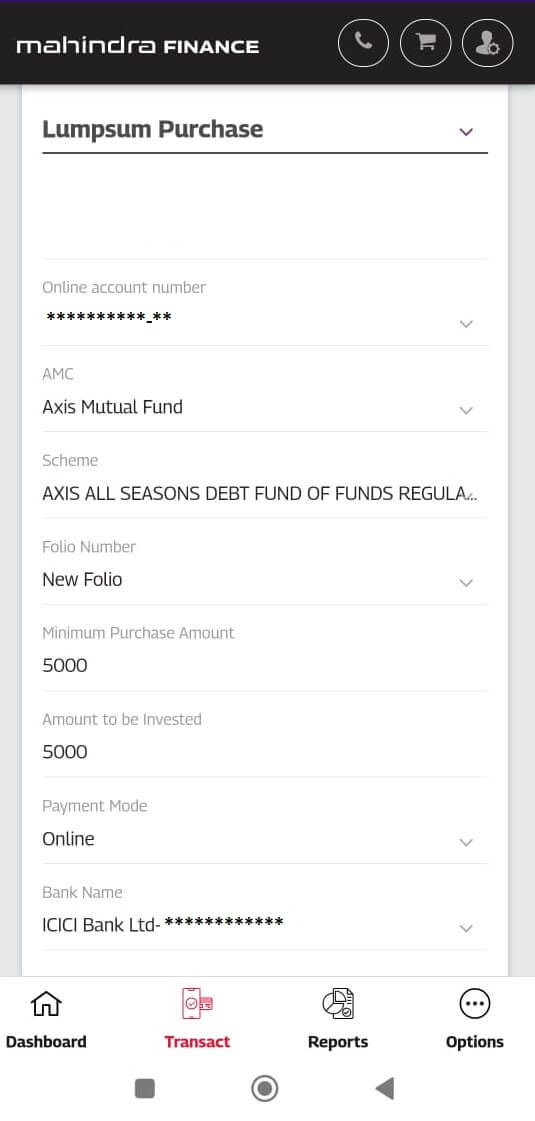

Fulfill your long term goals through Lumpsum investments or SIPs (Systematic Investment Plans). These are great tools to build long term wealth and they offer higher growth potential though the power of compounding.

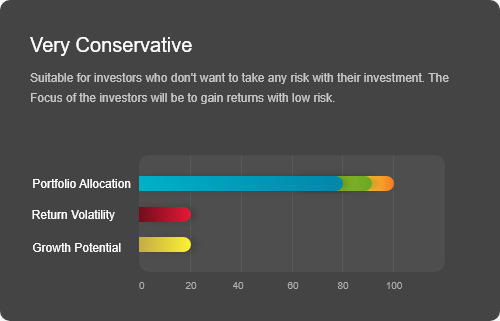

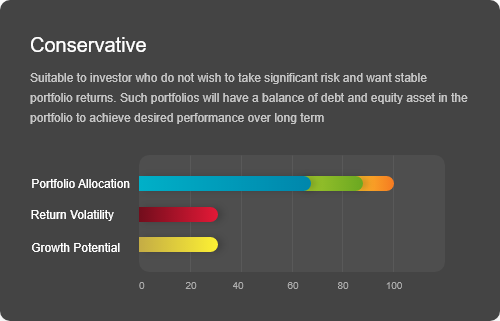

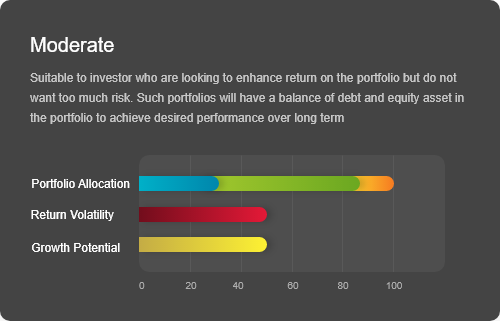

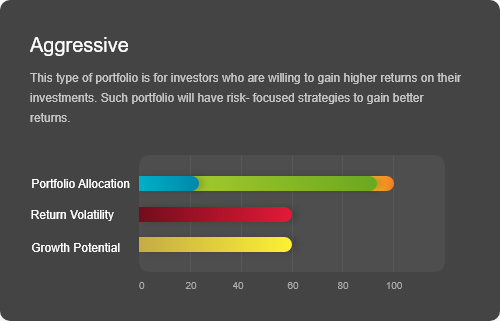

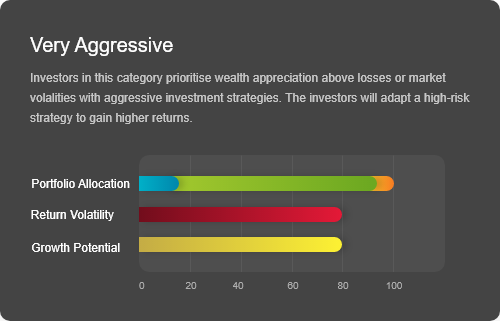

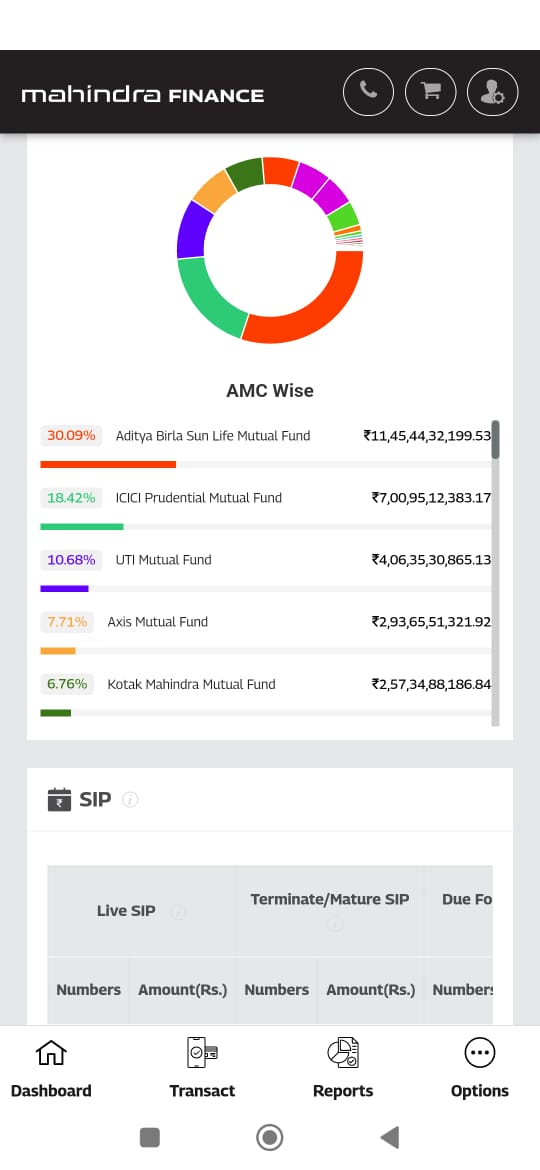

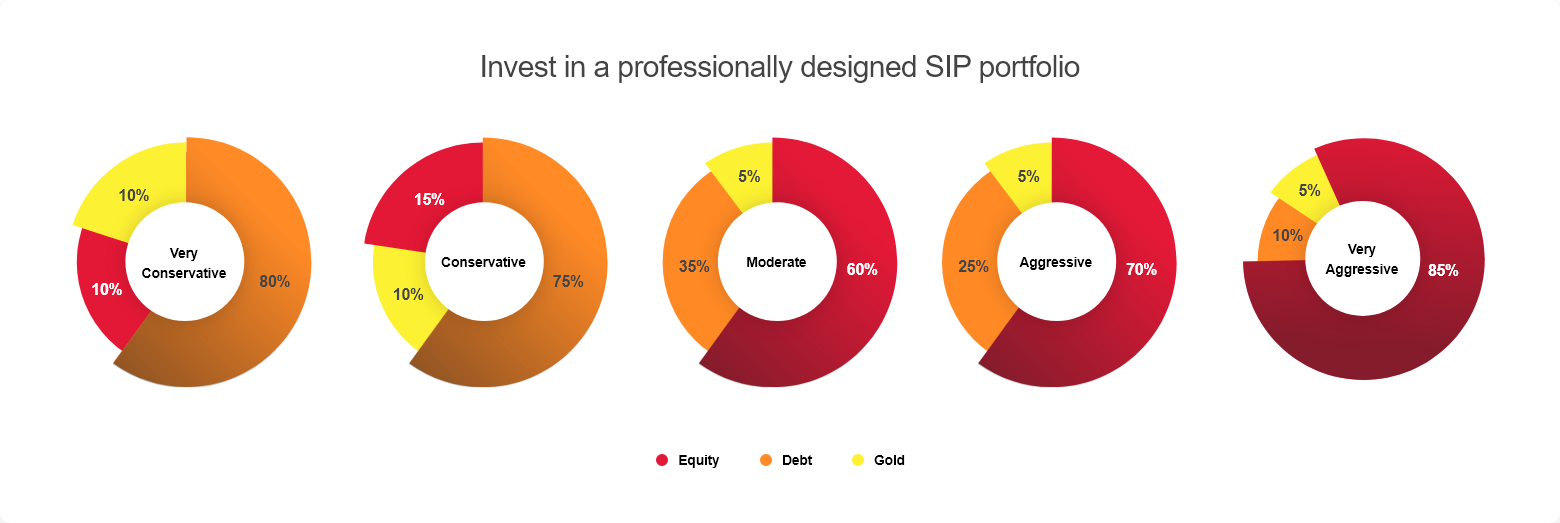

Portfolio management is important for all investors to minimise risk and maximise growth potential. Risk and return are the two important aspects of financial investment. Risk is the probability of incurring losses whereas return is an income earned through an investment.