Mahindra Finance understands the need for Utility Vehicles that can cater to the personal and business transportation requirements of customers. That’s why we provide structured Utility Vehicle loans and offer flexible repayment options, tailor-made to fit every budget and financial requirement. Whether you’re looking to buy a new or used Utility Vehicle, our long and reputable history in financing Utility Vehicles combined with flexible loan options can help you achieve your goals. Plus, with our hassle-free loan application process and quick approvals, you can get behind the wheel of your Utility Vehicle in no time.

Enjoy flexible repayment between 12 to 60 months on a monthly, quarterly or half-yearly schedule.

Approval can be granted within few working days, subject to the submission of the accurate documents.

Our reasonable and affordable interest rates are tailored to your profile, location and tenure.

Pay via Cash, Cheque or Online, we ensure you have all the flexibility you need to make your payments.

Our minimal documentation and simple eligibility criteria ensures you get access to funds quickly.

Avail stress-free, no collateral, utility vehicle loans without mortgaging your land or house.

Enjoy our transparent loan process with SMS updates, no extra charges and other restrictions.

Calculating your Utility Vehicle Loan EMI has never been easier. Use our Utility Vehicle Loan EMI Calculator to input your desired amount, interest rate and tenure, and view an instant summary of your EMI amounts. You can also simply adjust the amount and tenure to see how it affects your EMI repayments. Get on the road faster with our Utility Vehicle Loan EMI Calculator.

Select Your Loan Type

₹

₹

₹

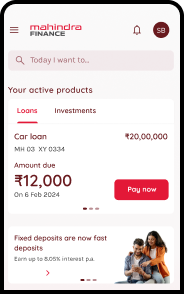

Our Utility Vehicle Loan application process is easy and gives you a quick turnaround. The loan application can be made both online and offline which means you can either visit the nearest branch or opt for our quick 4-step online process.

Start the process by simply submitting your Name, Number and Pin Code.

Our executive will contact you for additional details.

Submit the requested documents for eligibility check and verification

Once verified and approved, your funds will be sanctioned and disbursed.

KYC Documents (Aadhar card mandatory)

Proof of Income and Address

2 Colour Passport Sized Photographs

Disclaimer: MMFSL reserves the right to approve/disapprove the loan after the submission of documents.

Attractive Interest Rates based on your eligibility*

Interest RatesCharged based on product-specific, document, and stamp fees based on the prevailing rates set by the statutory authority and the location of the contract execution.

ChargesGet all the answers to your top Utility Vehicle Loans FAQs with Mahindra Finance

The finance amount is based on vehicle price & the loan eligibility as per the profile.

We do not fund any accessories unless it is a standard fitting by the OEM.

The interest rates offered are reasonable and are determined by the location of the customer, loan tenure and customer profile

The loan is available for a maximum period of 5 years.

Normally, the approval is given in few working days subject to the submission of the required documents. To check the documents required, click here.

Yes, a copy of the agreement will be provided to the applicant post loan disbursement.

No, collateral security is not required.

Not always.

To do so, you can send your request to the nearest Mahindra Finance branch. Click here to view a list of our branches.

Yes. You can remit your instalments in any of our branches. Click here to view a list of our branches.

Under the finance agreement, foreclosure is not contemplated. However, upon your specific request, we may advise the settlement amount to you and on remittance of the same, the necessary termination papers would be issued post loan closure.

On payment of the last instalment and any other pending dues as per the agreement, the termination papers including the RTO related papers would be issued.

The termination letter.

The no-objection letter addressed to the RTO.

Insurance endorsement cancellation letter

You can intimate the concerned branch, which you normally deal with. Otherwise, you can email us by clicking here.

Comprehensive insurance coverage is mandatory.

We do not insist on this, but please feel free to arrange for comprehensive insurance and produce the policy copy with our endorsement in time. We are always committed to our customers to provide a one-stop solution for all loans & insurance needs. We offer one of the best insurance solutions through our subsidiary company Mahindra Insurance Brokers Ltd. However, if you pay the premium along with monthly instalments, we can take care of your insurance needs.

Our innovative and flexible repayment tenures are designed to suit the needs of every borrower, with convenient and comfortable schedules. We offer monthly, quarterly and half-yearly repayment schedules depending on the type of product.