We recognize the crucial role that tractors play in farming operations in India by improving productivity and minimizing manual labour. To support the growth of agricultural businesses, Mahindra Finance is at the forefront of providing Tractor Loans to farmers. These loans assist in acquiring tractors with ease. We offer competitive interest rates and flexible repayment options. Loan amounts and terms are customized to each borrower’s need ensuring a perfect fit for every farming venture.

Tractors are the backbone of farming in India, increasing productivity and reducing manual labour operations. Mahindra Finance understands the importance of investing in equipment to support the growth of farming businesses. That’s why we are leading providers of Tractor Loans for farmers, a type of loan to help farmers and agricultural businesses purchase Tractors with ease. We offer flexible repayment options with competitive interest rates. Loan amounts and terms are tailored to each borrower’s need, ensuring a perfect fit for every farming venture.

Flexible EMI repayments between 6 to 60 months are available with reasonable interest rates.

We sanction secured and unsecured Tractor loans within 2 working days. No need to mortgage.

Our customizable tractor loans are available for Mahindra and Swaraj Tractors, perfect for your farming needs.

Get access to finances when you need with our minimal documentation process and eligibility criteria.

Avail stress-free tractor financing without mortgaging your land or house with our transparent loan process.

Get an SMS update at each stage. Enjoy our transparent Tractor Loan process with no extra charges or restrictions on the mode of repayment.

Calculating your Tractor Loan EMI has never been easier. Use our Tractor Loan EMI Calculator to input your desired amount, interest rate and tenure, and view an instant summary of your EMI amounts. You can also simply adjust the amount and tenure to see how it affects your EMI repayments. Make smart investments for your farm with our Tractor Loan EMI Calculator

Select Your Loan Type

₹

₹

₹

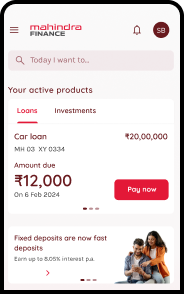

Our Tractor Loan application process is easy and gives you a quick turnaround. The loan is available both online and offline which means you can either visit the nearest branch or opt for our quick 4 step online process.

Start the process by simply submitting your Name, Number and Pin Code.

Our executive will contact you for additional details.

Submit the requested documents for eligibility check and verification

Once verified and approved, your funds will be sanctioned and disbursed.

KYC Documents

Proof of Income

Agricultural Land Ownership Document

Disclaimer: MMFSL reserves the right to approve/disapprove the loan after the submission of documents.

Attractive Interest Rates based on your eligibility*

Interest RatesCharged based on product-specific, document, and stamp fees based on the prevailing rates set by the statutory authority and the location of the contract execution.

ChargesStay up-to-date with the latest financial trends and expert insights on Tractor Loans with our blogs.

Get all the answers to your top Tractor Loan FAQs

No, there is no requirement to mortgage land to get a Tractor loan.

Convenience: Minimal documentation

Speed: Loan approval within 2 working days

Reach: Strong network of branches in rural and semi-urban India

Apply for your loan online or through any Mahindra Finance branch and receive a call back from a Mahindra Finance executive in your city or town.

There are no fixed minimum or maximum amounts. Tractor loans can be customised to suit your individual needs.

The minimum term period is 6 months and the maximum term is 5 years.

Down Payment is the difference between the price of the Tractor and the amount of the Tractor Loan. Depending on the financing options, you can opt for a higher down payment if you wish.