Don’t risk depleting your hard-earned savings in the face of unforeseeable financial emergencies. Mahindra Finance’s Loans Against Vehicles provides quick funds using your vehicle as leverage. With access to up to 95% of its value and competitive interest rates, we make the process fast and effortless with convenient loan tenure options and quick disbursals. Our simplified and transparent loan processing considers your car an asset, offering a stress-free solution to your urgent financing needs.

Get a quick valuation and access 95% of the vehicle’s value as a cash loan to meet your financial requirements

We finance most passenger and multi-utility vehicles available in the market that are under 10 years of age

Our affordable interest rates are highly competitive which means your overall cost of borrowing remains low.

We cater to all types of customers and require minimal documents for this type of loan.

Our simple and uncomplicated process can have your car loan sanctioned within few days, subject to valuation and document submission.

Calculating your EMI has never been easier. Use our Loan Against Vehicle EMI Calculator to input your desired amount, interest rate and tenure, and view an instant summary of your EMI repayments. You can also simply adjust the amount and tenure to see how it affects your EMI repayments. Make faster decisions with our Loan Against Vehicle EMI Calculator

Select Your Loan Type

₹

₹

₹

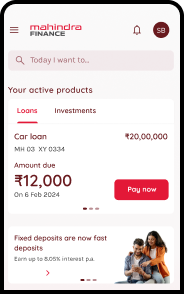

The Loans Against Vehicle application process is easy and gives you instant funds in your bank account. The loan application can be made both online and offline which means you can either visit the nearest branch or opt for our quick 4-step online process.

Start the process by simply submitting your Name, Number and Pin Code.

Our executive will contact you for additional details.

Submit the requested documents for eligibility check and verification

Once verified and approved, your funds will be sanctioned and disbursed.

KYC Documents - Passport/ PAN/ Aadhar

Proof of Vehicle Ownership (less than 10 years old)

Identity and Proof of Address

Disclaimer: MMFSL reserves the right to approve/disapprove the loan after the submission of documents.

Attractive Interest Rates basis your eligibility*

Interest RatesCharged based on your product-specific, document, and stamp fees based on the prevailing rates set by the statutory authority and the location of the contract execution.

ChargesStay up-to-date with the latest financial trends and expert insights on Loan Against Car with our blogs