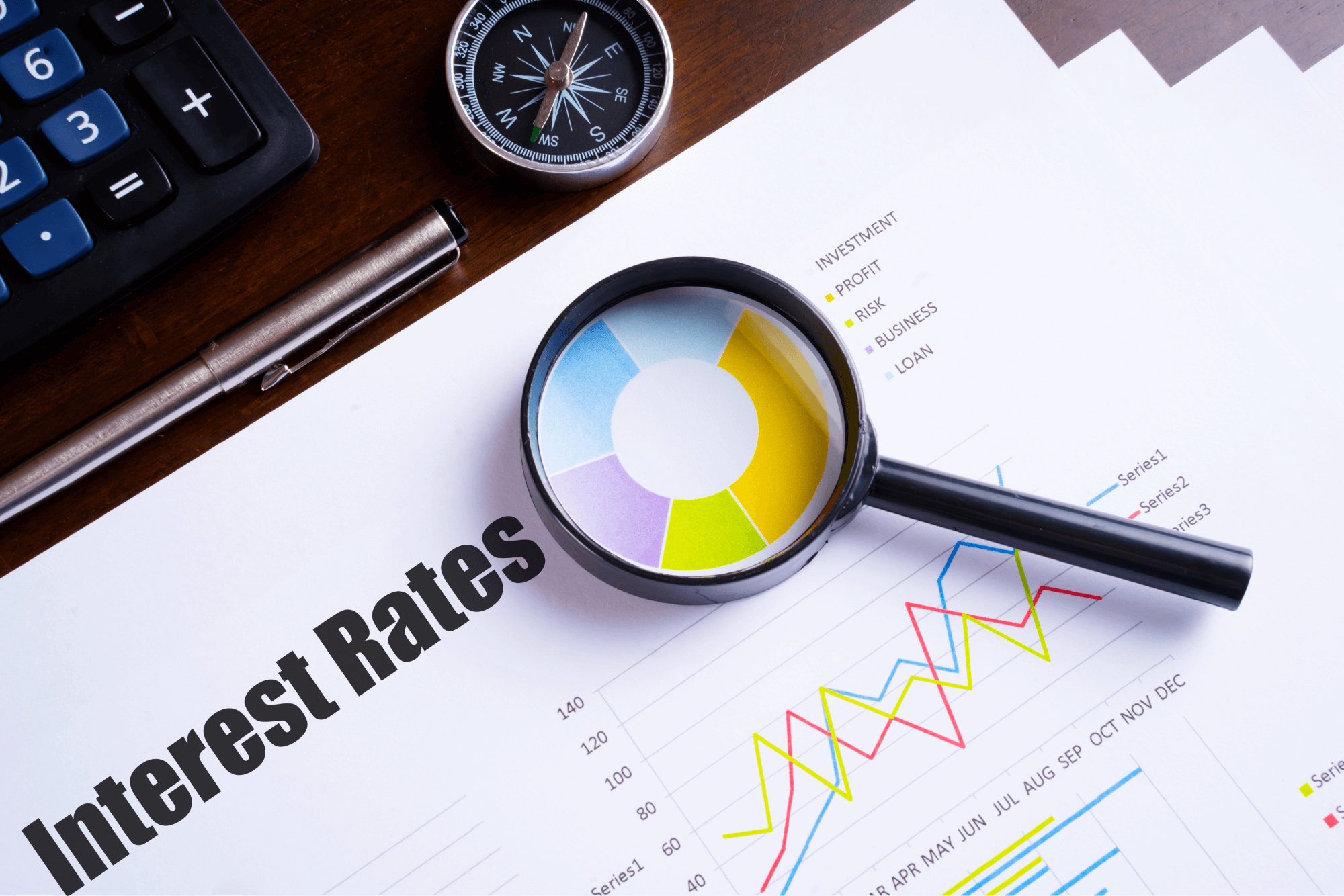

The guidelines to calculate premature withdrawal of Fixed Deposit are:

- To maximize your interest earnings, keep your deposit until maturity. Withdrawing between 6 months and 1 year incurs a 3% penalty on the interest rate.

- Withdrawals made after 1 year but before the maturity date incurs a 2% penalty on the rate of interest.

- Funds cannot be withdrawn during the initial 3 months of the deposit term.

- Withdrawals made between 3 and 6 months will not receive any interest.