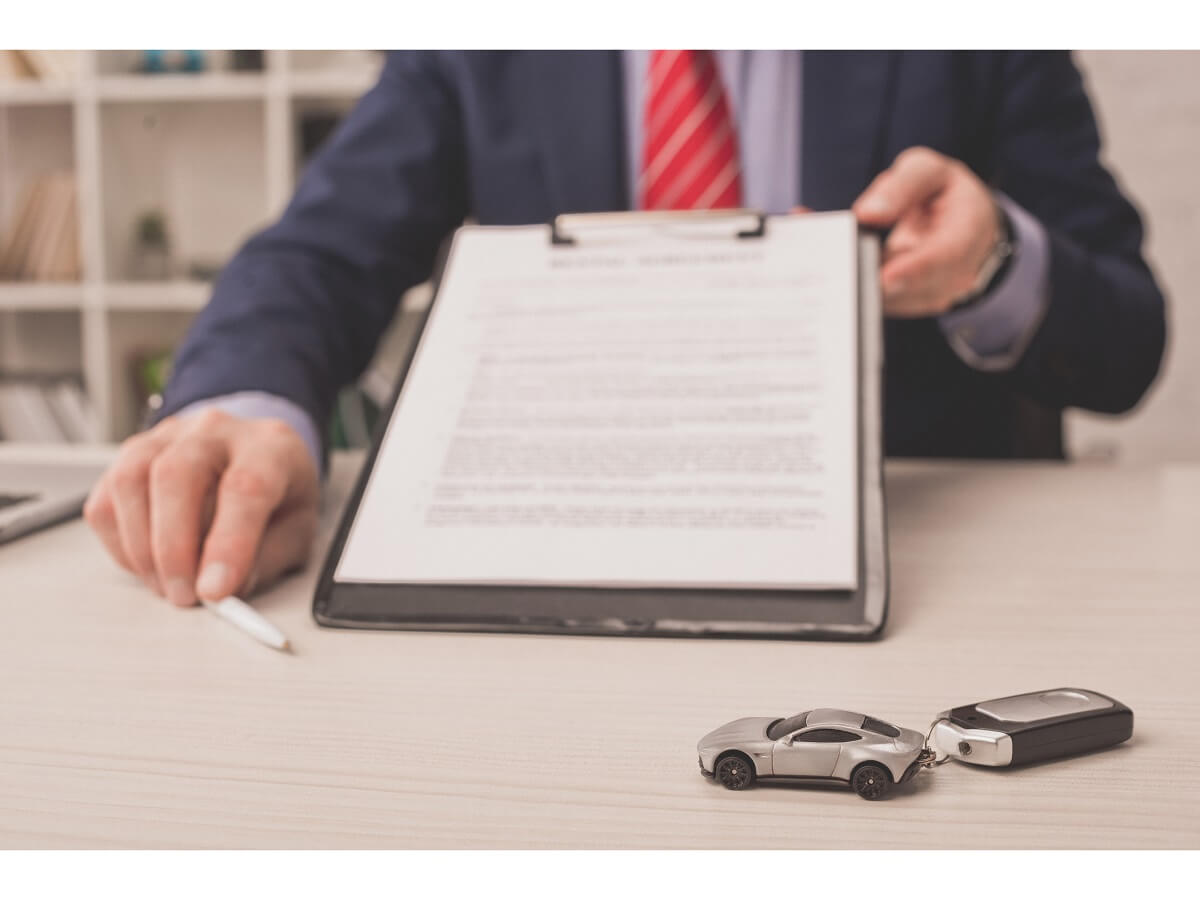

Car loan eligibility is a critical factor when applying for financing. Lenders evaluate your eligibility based on various factors, including your credit history and required documentation. To boost your chances of approval, consider the following:

- Proof of identity: Gather essential identity and residency documents to establish your credibility.

- Credit history: A good credit report reflects financial responsibility, increasing your eligibility.

- Down payment: While we offer maximum funding, making a down payment can enhance your approval prospects.

Securing financing for your dream car is an exciting journey. By understanding car loan EMIs and ensuring you meet eligibility requirements, you can increase your chances of approval and drive off in the vehicle you’ve always wanted. For more information and to calculate your Car Loan EMI, visit Mahindra Finance Car Loan EMI Calculator.