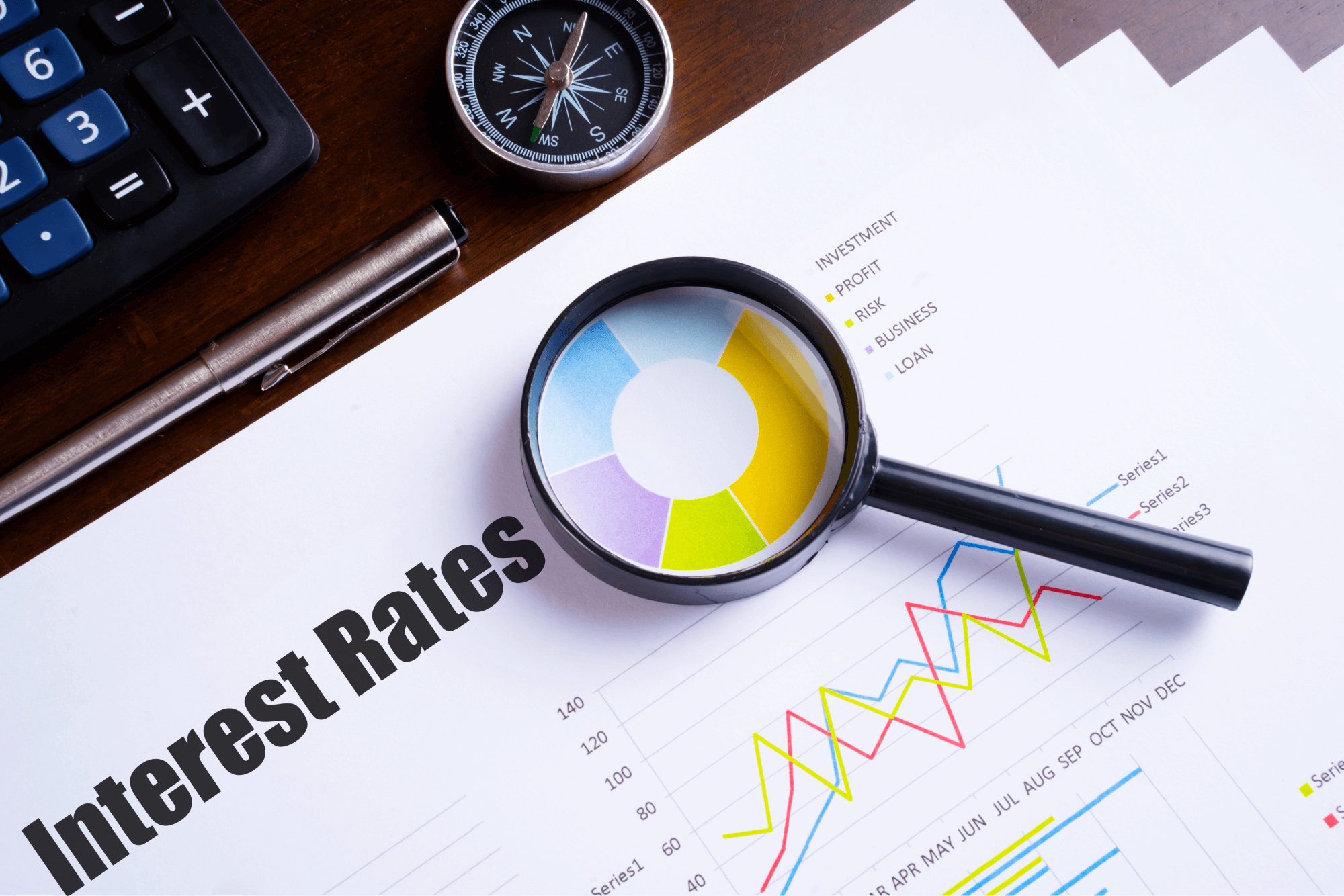

- Penalty, if charged, for non-compliance of material terms and conditions of loan contract by the borrower shall be treated as ‘penal charges’ and shall not be levied in the form of ‘penal interest’ that is added to the rate of interest charged on the advances. There shall be no capitalisation of penal charges i.e., no further interest computed on such charges.

- The Company shall not introduce any additional component to the rate of interest and ensure compliance to these guidelines in both letter and spirit.

- The quantum of penal charges shall be reasonable and commensurate with the noncompliance of material terms and conditions of loan contract without being discriminatory within a particular loan/product category.

- The penal charges in case of loans sanctioned to ‘individual borrowers, for purposes other than business’, shall not be higher than the penal charges to non-individual borrowers for similar non-compliance of material terms and conditions.

- The quantum and reason for penal charges shall be clearly disclosed by the Company to the customers in the loan agreement and most important terms & conditions/Key Fact Statement (KFS) as, in addition to being displayed on the website of the Company under Interest rates and Service Charges.

- Whenever reminders for non-compliance of material terms and conditions of loan are sent to borrowers, the penal charges shall be communicated. Further, any instance of levy of penal charges and the reason therefor shall also be communicated.