- The Company will consider all the documents submitted and the information provided, verify the creditworthiness of the customer and evaluate the proposal at its sole discretion. In case any additional information or documents are required the company will convey the same to the customer within a reasonable time.

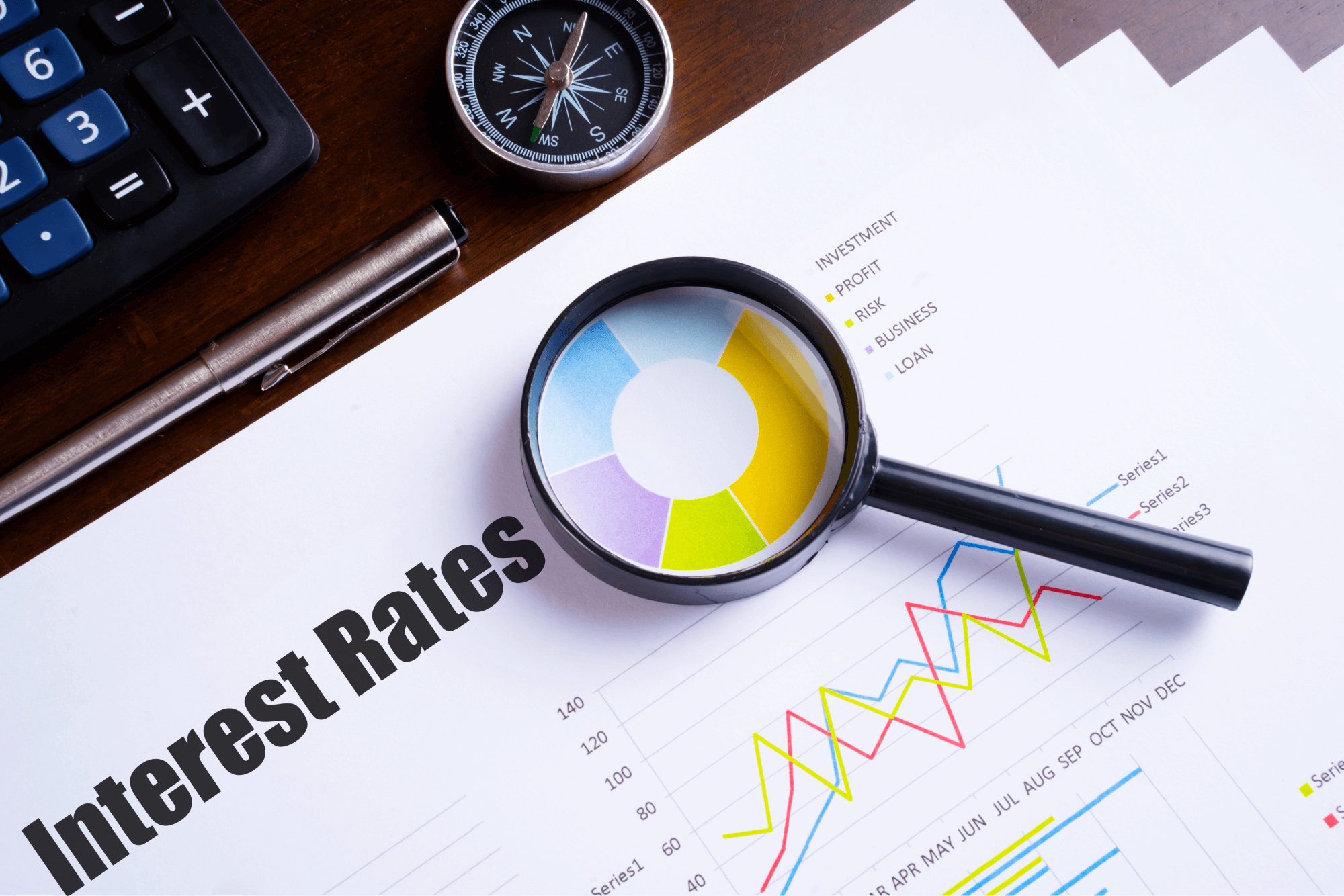

- After necessary assessment, the Company will convey in writing in physical/digital mode to the borrower, in vernacular language of language as understood by the borrower, by means of an offer letter or any other mode, the amount of loan approved along with the terms and conditions, including the annualised rate of interest thereof. It would keep the acceptance of these terms and conditions by the borrower on the Company’s files in digital (including OTP based) or physical mode as applicable.

- The Company will mention the penal interest charged for late repayment in bold in the loan agreement.

- The Company will furnish a copy of the loan agreement along with a copy each of all enclosures quoted in the loan agreement to all the borrowers at the time of sanction/disbursement of loans.