Earn & Pay Segment of Customer

Enabling livelihood creation by evaluating the earning potential of customers rather than relying on past financial history.

Mahindra Finance has established a formidable presence in rural and semi-urban financing over the last 25 years. With continuous diversification and expansion, our company has created a strong ecosystem of financing to serve underprivileged communities. Along with its commitment to financial sustainability, we are also dedicated to promoting financial literacy, inclusivity, and diversity at every step of our journey.

The Mahindra Rise initiative is a testament to the company’s success, with its three pillars of mindset, progressive thinking, and positive change. We are proud to state that our Corporate Sustainability Responsibility (CSR) is one of the critical elements under the third pillar, which places great emphasis on creating positive changes in our ecosystem.

Enabling livelihood creation by evaluating the earning potential of customers rather than relying on past financial history.

Offering customised products, flexible repayment schedules and financial solutions to the unique needs of rural customers.

Providing financial literacy and prioritising improvements of livelihood, health & education in communitie.

Focus on catering to the rural and semi-urban areas of India that lack access to conventional banking services.

Hiring local individuals, generating job opportunities and gaining valuable insights into markets and customers.

Preference for local suppliers, providing business opportunities and improving service levels through constant engagement.

Net Zero on Scope 1+2 emission ( RE page & energy efficiency )

Net Zero on water and waste *

( reuse, reduce & recycle )

Adopting material circularity *

( reduce, recycle & green material )

Transition to green portfolio ( TVs in auto, LMN & Logistics; Green Buildings & Resorts; Green Energy – solar, hybrid, storage )

Supporting transition to net-zero supply chain * ( e.g – Logistics )

Industry circularity* ( e.g.- auto recycling )

Promoting regenerative agriculture ( via improved farming techniques )

Afforestation at scale ( Hariyali Program )

Biodiversity conservation ( impact assessment and restoration )

Mahindra Finance has established itself as a leading financial institution, a top employer, and a responsible corporate citizen of the country. We invite you to journey through our accomplishments over the years.

We push the boundaries to create innovation and beneficial products to transform the lives of our customers.

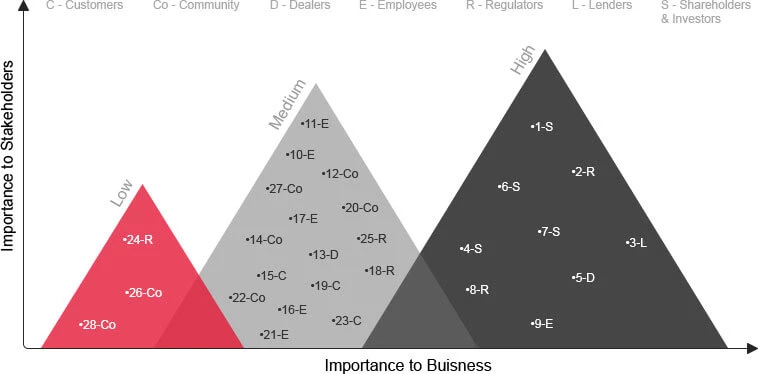

An understanding of materiality enables us to prioritize the issues that matter most across our value chain. The materiality matrix shown below reflects the outcome of our 2016 materiality assessment.

The topics with the highest priority for stakeholders and the biggest estimated impact on our business appear in the top right of the chart.