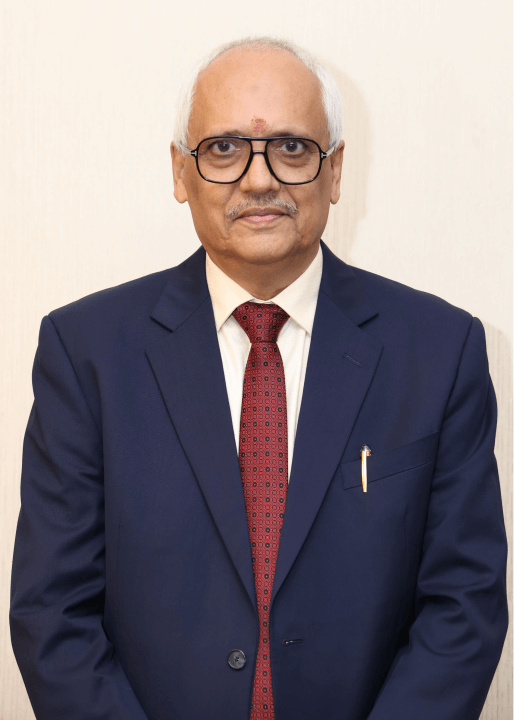

The collective expertise and vision of our board of directors guide and inspire us to venture into the unknown, by empowering people to achieve their goals.

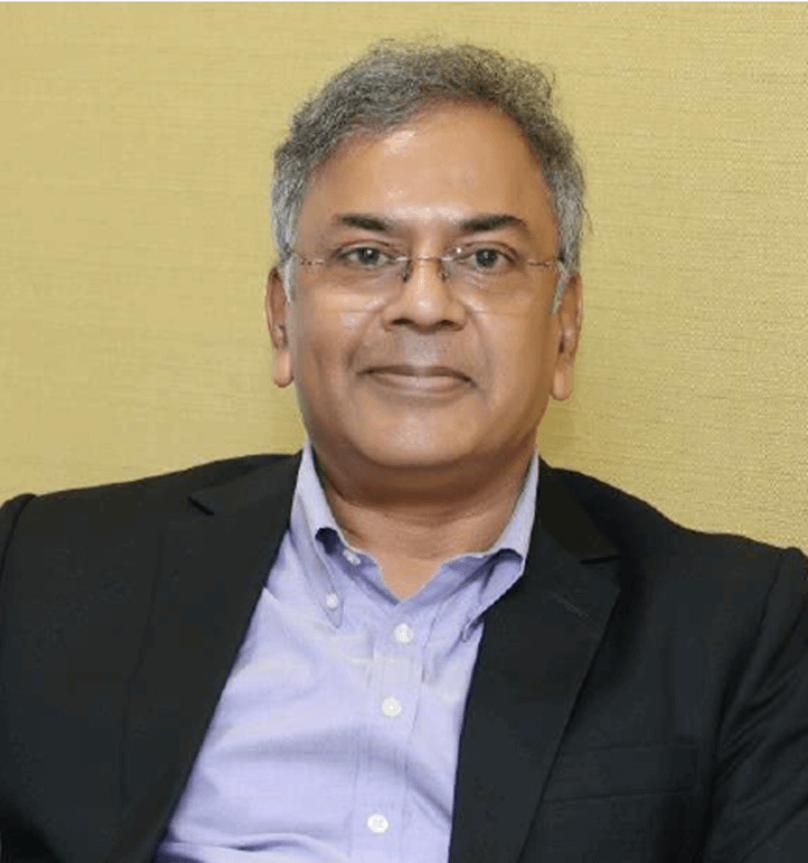

Chief Executive Officer – Mahindra Manulife Investment Management Private Limited